Inverted Yield Curve Definition & Example | InvestingAnswers

Dec 4, 2020 · An inverted yield curve, also called a negative yield curve, is a yield curve indicating that short-term yields are higher than long-term yields.

The inverted yield curve: What does it mean for the economy?

Dec 19, 2022 · The yield curve is a line chart that plots interest rates for bonds that have equal credit quality, but different maturity dates. Yields are normally higher for bonds that mature …

Normal Yield Curve Definition & Example | InvestingAnswers

Jun 1, 2021 · Also called a positive yield curve, a normal yield curve is one in which short-term yields are lower than long-term yields.

Yield Curve Definition & Example | InvestingAnswers

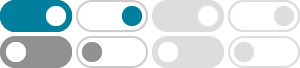

Nov 24, 2020 · Below you'll find an example of an inverted yield curve: Finally, a flat yield curve exists when there is little or no difference between short- and long-term yields.

Term Structure of Interest Rates - InvestingAnswers

May 31, 2021 · What is the term structure of interest rates? From a flat term structure to inverted yield curves, discover how interest rates influence bond values.

Search Page | Investing Answers

Nov 22, 2025 · An inverted yield curve, also called a negative yield curve, is a yield curve indicating that short-term yields are higher than long-term ...

Yield Curve Risk Definition & Example | InvestingAnswers

Sep 16, 2020 · A yield curve can be positive (meaning the line goes up and to the right because investors require a higher rate of return for lending money for a longer period), inverted …

Heading for a recession? Here’s why the yield curve matters

May 18, 2022 · A key bond market signal - the US yield curve - is displaying warning signs. A yield curve is a visual representation of bond investors’ feelings about risk. 2-year US Treasury …

Inflation Risk | Meaning & Example | InvestingAnswers

Sep 16, 2020 · Here are the two most popular ways to understand what future inflation risk may be: Yield curve. The yield curve can give an indication of where inflation may be headed. A …

A 'Crystal Ball' For Stocks And Bonds? - InvestingAnswers

Jun 1, 2021 · A flat curve exists when there is little or no difference between short- and long-term yields. Here's what a positive yield curve looks like: People try to use the yield curve as a …